Salford City Council is seeking public feedback on proposed updates to its Council Tax Reduction (CTR) scheme, aimed at making support for low-income households fairer and more targeted.

Residents are being asked to take part in a consultation on three changes to Salford’s CTR scheme, which provides financial help to those on the lowest incomes with their council tax bills. The consultation is open until Thursday 1 January 2026, with any agreed changes set to come into effect from 1 April 2026.

Council Tax Reduction is Salford’s largest form of discretionary financial support. The council recently introduced a fairer, income-banded model to better reflect different household circumstances. Based on insights from this, three new proposals have now been put forward to improve the scheme further.

Councillor Jack Youd, Lead Member for Finance, Support Services and Regeneration, said: “Council Tax Reduction is a vital component of our anti-poverty work. These proposed changes are designed to strengthen that support, particularly for vulnerable households, while keeping the scheme cost neutral.”

The three proposals include:

1. Removing Universal Credit Transitional Protection Payments (UCTPP) from CTR assessments

This aims to support people who have moved from legacy benefits, such as Employment and Support Allowance (ESA), to Universal Credit. While UCTPP offers short-term protection, over time many see a fall in income. Removing these payments from the assessment could prevent further disadvantage.

2. Disregarding 45% of state or occupational pensions

In response to concerns from the council’s Welfare Rights and Debt Advice service, this change would support mixed-age couples where a working-age partner provides care for a pension-age partner receiving disability benefits. The adjustment would ensure such households are not penalised under the current income assessment model.

3. Retaining the CTR Transitional Protection Scheme

This provides a safeguard for households who have not yet migrated to Universal Credit and may still rely on legacy benefits. The council expects the number of these households to reduce significantly by the end of the financial year, but the protection will remain in place as a contingency. Those identified as needing help will be supported by the BetterOff service to access benefits and employment advice.

Residents are encouraged to take part in the online survey and help shape a fairer and more inclusive CTR scheme for the future. The consultation can be accessed through the council’s website.

Any changes agreed will be introduced from the start of the new financial year in April.

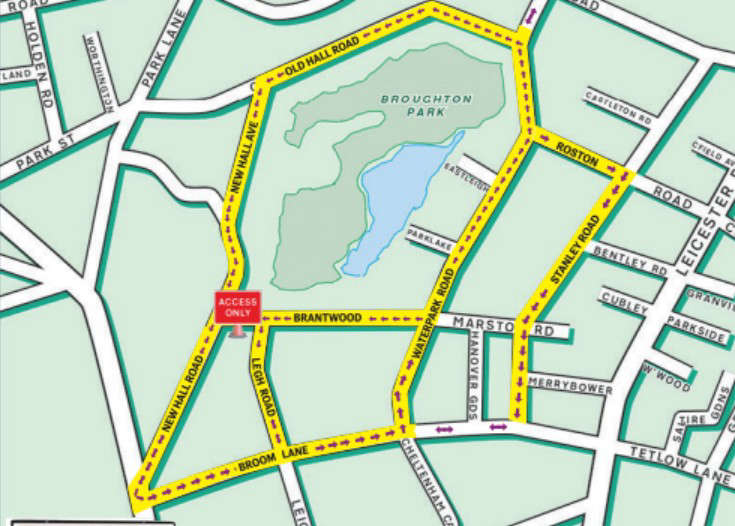

Road closures in place as Purim celebrations begin

Road closures in place as Purim celebrations begin

University of Salford apprentice named policing apprentice of the year

University of Salford apprentice named policing apprentice of the year

Two arrested after Salford carjacking outside Black Friars store

Two arrested after Salford carjacking outside Black Friars store

Salford City Council announces death of Councillor David Lancaster MBE

Salford City Council announces death of Councillor David Lancaster MBE

Comments

Add a comment